Education

Get to Know More about Derivatives in Commodities

3 Minutes

Read

•

Apr 29, 2024

Forward and futures contracts are common derivatives that offer hedging and leverage in commodities. However, they require understanding of risks like credit exposure and potential losses from volatility.

LAST UPDATED:

March 5, 2025

.avif)

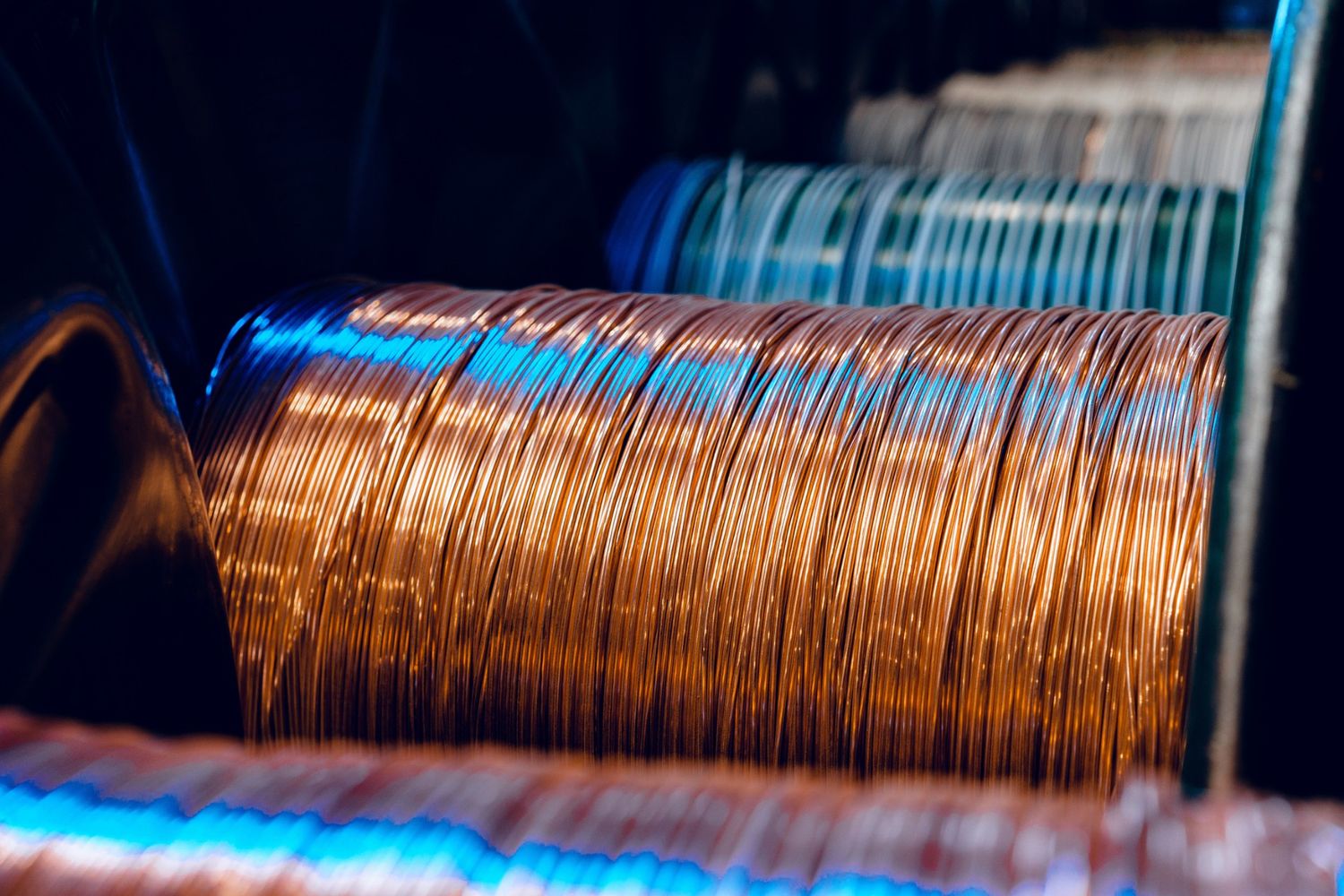

Derivatives, financial instruments deriving value from underlying assets (commodities) or indices, play a pivotal role in modern finance. Among them, forward contracts stand out as agreements between two parties to exchange assets at a predetermined future date and price. Understanding derivatives, especially in the context of forward contracts, involves grasping key concepts shaping financial landscapes.

Derivative Characteristics

Derivatives exhibit unique traits such as leverage, enabling investors to control larger positions with limited capital. They serve diverse purposes, including speculation on price movements, hedging against risks, and enhancing portfolio management strategies. The value of derivatives is intricately linked to commodities, often marked to reflect current market conditions.

Derivatives Roles in Commodity Markets Throughout History

Commodity derivatives, tracing back to ancient Mesopotamia, have evolved over millennia into modern electronic trading platforms. They have facilitated trade since the 2000s B.C., enhancing efficiency in agricultural markets and enabling transactions across various historical periods, including the Roman Empire and medieval Europe. Throughout the Renaissance and into the 17th century, derivatives served as mediums of exchange, with hubs like Amsterdam and London paving the way for modern markets. In more recent history, institutions like the Chicago Board of Trade introduced forward contracts, marking significant milestones in derivatives trading. In financial services today, derivatives are crucial for risk management and maintaining market liquidity.

Market Dynamics and Risk Considerations

Derivatives, including forward contracts, can be traded on exchanges or over the counter (OTC). However, OTC trading introduces credit risk, emphasizing the need for both parties to ensure each other's financial stability. Additionally, the marking to market process helps manage counterparty risk and keeps parties informed of their current obligations.

At ACM, our mission is to facilitate connections and serve all participants within the dynamic commodity space.

Whether you’re a commercial seeking risk management solution, or a financier aiming to tap into Asia's commodity markets, ACM serves as the essential bridge in this bustling hub.

Benefits, Risks, and Historical Context

Derivatives offer advantages such as locking in prices, hedging against unfavorable movements, and leveraging positions. However, risks, including counterparty risk and sensitivity to numerous factors, must be carefully considered. Historically, derivatives have ancient roots, with recent decades witnessing an expansion in their variety, complexity, and usage.

Derivatives in Action

Derivative markets facilitate risk shifting, where hedgers use these instruments to manage risk exposure, leading to more stable costs and revenues. Speculators play a crucial role, absorbing risk from hedgers in exchange for a risk premium. This risk distribution mechanism ensures that participants can manage risk at a cost, while speculators expect profitable outcomes.

Conclusion

Derivatives are fundamental in financial services, especially forward contracts, for effective risk management. Their ability to manage risk, provide liquidity, and enable diverse strategies contributes significantly to the functioning of modern finance. However, understanding their complexities and associated risks is paramount for effective and responsible use in achieving financial goals.